March 26, 2016

Will Large Agri-Investments Rescue Africa?by

Paul Conton

The terms of this deal are similar to other land lease arrangements negotiated in recent years with the Government of Sierra Leone and with other African governments. With the rise of crude oil prices in recent years, albeit dramatically reversed since 2014, and advancing knowledge in biofuels production, Africa, with its fertile soils and abundant sunshine and rainfall, has been increasingly favoured by biofuels producers as the ideal location for growing crops for energy. And if crops for energy, why not crops for other purposes too? African governments, perenially cash-strapped, have welcomed this new source of funding with open arms, offering cheap land, and generous tax incentives to investors. While data are sparse and sometimes contradictory, the World Bank estimates that some 45 million hectares in Africa were transferred in land deals between 2007 and 2010 (Deininger, K., Byerlee, D., Lindsay, J., Norton, A., Selod, H. and Stickler, M. (2011). Rising Global Interest in Farmland: Can It Yield Sustainable and Equitable Benefits?. The World Bank, Washington, DC.

In the Socfin case, the end product of the Pujehun oil palm plantation is not a biofuel, but palm oil for local consumption. Socfin has extensive rubber and oil palm

"One aspect of the Makeni Project that

makes it of particular interest to the international community,

particularly development policy-makers and

practitioners, is the wide range of mitigation measures that ABSL

(Addax) has undertaken in the host communities...if

a project held up as a “model” for sustainable FDI in Africa has such

mixed results, it raises questions about the feasibility of using

agro-industrial FDI to drive rural development in Sierra Leone...good

governance is crucial to achieving sustainable development benefits,

and to ensuring that the rural poor share in those benefits and are not

harmed. Our research suggests that Sierra Leone’s institutions are not

yet up to that task."

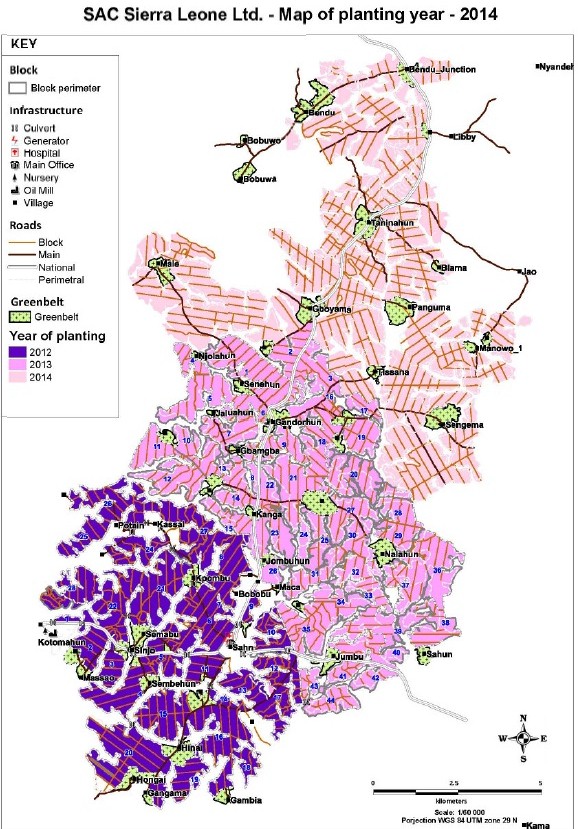

Socfin on the other hand appears to have a much narrower view

of its

corporate social responsibility than Addax. The map at right, taken

from a 2015

environmental assessment of the company's operations by Environmental

Resources Management shows the affected villages more or less

completely engulfed by the company's plantations. This map alone should

be sufficient evidence to indicate that the affected villagers have

good cause to complain. Amazingly the environmental assessment

candidly

acknowledges (p. 10) that the green areas shown around the villages

"were preserved to be used by the communities for subsistence (my emphasis) farming."

of its

corporate social responsibility than Addax. The map at right, taken

from a 2015

environmental assessment of the company's operations by Environmental

Resources Management shows the affected villages more or less

completely engulfed by the company's plantations. This map alone should

be sufficient evidence to indicate that the affected villagers have

good cause to complain. Amazingly the environmental assessment

candidly

acknowledges (p. 10) that the green areas shown around the villages

"were preserved to be used by the communities for subsistence (my emphasis) farming."Socfin and Addax are but two of many large agricultural investments in Sierra Leone The group Green Scenery, in its 2013 publication Factsheet on Large-Scale Agri-Investments in Pujehun District, Sierra Leone reported that an astonishing 94% of arable land in the district had been leased to nine investors including Socfin. In 2012 one of the biggest investments of them all was announced by the government and China Hainan, a 135,000 hectare rice and rubber plantation stretching over three districts.

Is all this helpful to Sierra Leone, indeed, since it's a continent-wide phenomenon, to Africa? Are we about to see, with these huge investments, a change in the continent's fortunes, an arousal from slumber? What will likely be the effect of this massive injection of capital into the African countryside?

The World Bank document cited above, long and wide-ranging, provides some useful insights. Along the way, it explodes at least a couple of widely-held assumptions:

(1) Agricultural Foreign Direct Investment is always, or at least usually, good. Not neceesarily so, say the authors. And good for whom? Not even always good for the investing companies, a considerable number of whom, like Addax Sierra Leone, have run into difficulties. And certainly not good for the competent small farmer - "Smallholders’ income is 2 times to 10 times what they could obtain from wage employment only." (p. 83).

(2) Increasing farm sizes yields greater efficiencies. Mega farms are the most efficient. Tiny smallholder farms are simply uncompetitive. Not true, say the authors. It varies from one situation to another, but "there is no strong case to replace smallholder with large-scale cultivation on efficiency grounds." (p. 83). "With a total export volume of 4.6 million t, Vietnam is a major global exporter and low-cost producer of rice, with an average farm size of 0.5 ha and labor intensive technology." (p. 82)

Low African yields

Wading through the various documents, one gets the sense that the agricultural experts are truly baffled at the African rural predicament. Over 50 years of Independence, through plan after plan (the World Bank has just announced a new $55million smallholder initiative in Sierra Leone in conjunction with Britain's DFID), project after project, theory after theory, nothing seems to have worked. Agricultural productivity has remained a fraction of what is being achieved elsewhere. For the last 50 years, the known constraints to higher African yields - pests, weeds, disease, poor water control, poor seed management, poor fertility management, lack of access to credit, inputs, farm machinery and animal traction, shortage of labour - for the last 50 years these have all been known and addressed by governments and international agencies, to little avail. The rice farmers of Asia, the sugar cane farmers of Brazil have built massive, new export businesses even as African farmers have languished. In Latin America soybean production increased from 33 million tons (t) to 116 million t from 1990 to 2008, making the region the world’s largest soybean exporter. In Africa on the other hand, rice imports have been steadily rising. Yields in the major African food crops, maize, millet, sorghum, rice are a fraction of what they are elsewhere, a huge factor in African rural poverty. In maize Africa achieves just 20% of potential yield, in soybeans just 32% (World Bank, p. 130, Table 3.3).

In 2013 Addax's FDP programme in Sierra Leone planted 60 community fields, 1858 ha, with rice, supplying 18,400 local people for the year, with a yield of 1,155 kg/ha. The estimated yield of the local people planting on their own farms was 300 kg/ ha. To achieve the same output they had to use almost four times as much land. Through their FDP programme Addax really is saying to the local people, to the government, to all of us, "You really don't need to break your backs ploughing and sowing all that land to achieve this output."

African agriculture is bedeviled by the bush fallow system, extraordinarily wasteful of land. Under this system land is planted one year out of perhaps eight or ten or twelve (the exact number varies). In the other years the land lies fallow in order to allow it to regain its fertility. The system might have had its merits in traditional, sparsely populated settlements of days long gone, where population pressures were moderate (wars and disease took a great toll) and contact with the outside world was minimal, but today bush fallow, and much of the socio-economic baggage that goes with it, is doomed. In today's world the system is a major contributor to African poverty. With all other serious economies making efficient use of their farmland, Africa can not afford not to do likewise. Internally, with fast-rising African populations (true, urban populations are rising faster, but rural populations are also increasing - according to Statistics Sierra Leone, rural population in 2004 was over 3 million, approximately 50% greater than the total population at Independence in 1961) the pressure on the land becomes greater and greater as more and more people seek to eke out a living from the same quantum of land. Without an increase in productivity of the land, the certain result is continuing reductions in per capita rural income and increasing rural poverty stretching out into the forseeable future. Externally, the competition is, if anything, greater. The rice farmer in Burma or Thailand, far more productive than his African counterpart, can ship his surplus to rice eaters in West Africa using transport, communications and banking links far more advanced than they were even thirty years ago and with the backing of global agreements such as GATT. In a global economy where huge cash flows, made at the click of a button are constantly in search of viable investments, the lands themselves are increasingly vulnerable. All other things being equal farmland that is only producing crops one year in every ten is worth one tenth the value of land that is being used every year. The bush fallow system is the basis for extremely low valuations of land and enables external multinational companies with the capital and knowhow to raise crops every year to make seemingly attractive offers for African farmland. The agri-investor, planting every year, with higher yields than achieved by the local farmer, can grow ten times the crop achieved by the villager using bush fallow, earn ten times the revenue and pay significant taxes on it to government. This situation has proved extremely tempting for African governments, not to mention African chiefs. The land which these agri-investors are given, seemingly unused African bush, often turns out to be farmland within the African bush fallow system, setting the stage for confrontation between investor and local farmer. Such as the clash on a Socfin plantation that led to the Sierra Leone High Court case mentioned at my start.

Who owns the land?

Much of the debate about the advisability or otherwise of large land investments by outside investors centers on two options: should the status quo, community-held lands, continue? Or should large corporations be given free rein to use their economic muscle to tame the African countryside? Both sides have strong supporters. Environmentalists, nationalists, civil society activists and some UN agencies raises their hands in horror as multinationals acquire traditional lands long worked by rural people. Corporations, free-traders and the business-minded maintain that foreign direct investment can only be for the good. There is a third option, but it is without a strong lobby: Transfer legal ownership of the land to individual local landowners and let them decide what to do with it.

African agriculture is bedeviled not only by the bush fallow system but by archaic traditional land tenure systems. Land is very often held communally, by the entire village or by large, dispersed, often polygamous families descended over several generations, without secure, legal title. Demarcation of land is haphazard at best, without the benefit of the services of professional surveyors. Control of family lands is often vested in the eldest male relative, who must sort out competing claims, and which control passes on his death to the next in line, often from a different branch of the family. In disputes, which are not uncommon, the Chief, held to be the custodian of all lands, arbitrates.

Basic economics, common sense and long observation all tell us that a man is more likely to make long-term investments in fixed capital when his title to the land on which the capital is fixed is secure and he can pass this title at his death to his chosen successors. Yes, as the various reports make quite clear, villagers are dirt poor and are barely scraping enough together for a daily meal, let alone long-term capital investment, but might a change in the ownership structure make even just a teeny, weeny bit of difference, to be compounded over the years and decades into something substantial? If he has clear title, might that farmer possibly make the sacrifice to build that irrigation channel from the river to his land or dig and maintain that well to be passed on to his sons? If even he can't afford it, might his brother in Freetown, with a little cash to spare, be more willing to help him put up a concrete structure rather than that transient mudbrick one if title is assured and the farmer can designate his successor? These little, private investments, replicated over the country and amplified over the years, could, just could, become a mighty flood to transform the country, even the continent.

"As

long as property rights to land and, where necessary water, are well

defined .... productivity- and welfare-enhancing

transactions can occur" (World Bank, p. 82); "If

rights are well defined, if land markets function competitively, and if

information is accessible to all, land prices should ensure that a

mutually satisfying outcome is achieved" (p. 83);

"In Indonesia, limited ability to uphold local rights, together with

free provision of land to large investors, led to processes of area

expansion that caused immense social disruption and environmental

damage." (p. 90) "The

export growth witnessed in countries such as Vietnam, Thailand, and

Peru following a clarification of the property rights system

illustrates the importance of secure property rights." (p. 90)

In addition to private investments on the land, might the banking system be more willing to give out loans where title is assured? Some, including the authors of the World Bank report, rule out this possibility in the forseeable future, but if the objective is worthwhile, what better time than now to begin working for it?

Given the impenetrability of the African bush, is it feasible to contemplate surveying an entire continent? Again, if the objective is worthwhile, what better time than now to begin work on it? Land markets can not function efficiently if the land is undefined. If, in the fifty plus years of Independence, surveying had progressed at the rate of just 1% of total land per year, the job would have been far advanced by now. Has anything comparable been done before? According to the World Bank:

"...in

Thailand ... a land titling program was initiated to provide tenure

security and allow land markets to develop. Until 2004, this program

issued 12 million out of a total of 26 million titles countrywide"

(p.70)

"The

potential impact is illustrated by Mexico, which in slightly more than

a decade registered rights to more than 100 million hectares (ha) of

rural ejido land, two-thirds of it managed by communities and one-third

by individuals. Every household receives a certificate to three types

of land: the house plot, one or more parcels of individually cultivated

land (which can be transferred within the community but not to

outsiders unless the whole ejido decides to join the private property

regime), and a proportional share of communal land. This process also

established an open and accountable internal structure for the ejido

that entails a clear separation of powers, supervised by a specially

formed office of the agrarian ombudsman.

Mexico’s reforms demonstrate not only that it is possible to register property rights on a large scale and in a fairly rapid way, but also that doing so can help to resolve long-standing conflict on a massive scale. Moreover, there is evidence that doing so encouraged investment..." (p. 150)

Mexico’s reforms demonstrate not only that it is possible to register property rights on a large scale and in a fairly rapid way, but also that doing so can help to resolve long-standing conflict on a massive scale. Moreover, there is evidence that doing so encouraged investment..." (p. 150)

One way or the other, change is upon us

Whether one likes it or not, aggressive capitalist interventions like those of Addax and Socfin are with us to stay, with the support even of cautious international financing institutions like the ADB and IFC. Even though it's clear that the local people's interests are not well served by these agreements, it's also clear that the local people were using the land terribly inefficiently in the first place and this is what gives these companies entree. Today, in our global village, land has become an internationally traded commodity. Even though Sierra Leone's archaic land laws prevent or severely restrict buying and selling of land in the provinces by individuals, villagers considered too simpleminded to own land outright no matter what the UN human rights charter says; even though discriminatory laws today prevent people of the capital owning land in the provinces, economic disparities and economic opportunities have become so great that powerful international corporations can bypass red tape, go to the heart of government and induce transfer of what was once sacred. And by the nature of these agreements, corporations and businesses who hold them can in turn sell them on to other interested entities.

The Sierra Leone countryside, indeed the African countryside, simply has to change. There is no other way. African cities can not continue to absorb the unemployed or underemployed, the landless and the destitute of the countryside. The rest of the world is not going to stand still and quiet in the face of commercial opportunities in Sierra Leone and Africa. If there are no internal African adjustments the rest of the world will continue to grow food in their own countries more and more efficiently and sell more and more of it to Sierra Leone and Africa. The rest of the world will look at the huge, unrealized potential of the African countryside and will use its vast amassed wealth, to buy African governments and African chiefs and poverty-stricken African villagers and African lands and make efficient use of the lands and realize even more profits. One way or the other, whether through internally decided, rational adjustment, whether through trade and investment, whether through political and economic takeover, whether through demographics, whether through revolution, change will come.

United Nations bodies and international authorities are normally extremely cautious in calling for change to traditional rural societies and social structures. But in today's world, change will come no matter what you do. The entire world has had to adjust to changes in technology, in demographics, improvements in health, changes in governance systems and best practice, vastly expanded trade and commerce opportunities, advances in agricultural knowledge and agricultural competition. Huge adjustments have had to be made by all peoples everywhere. Why should the African countryside be different?